New York Governor Hochul Vetoes False Claims Act Amendment

[ad_1]

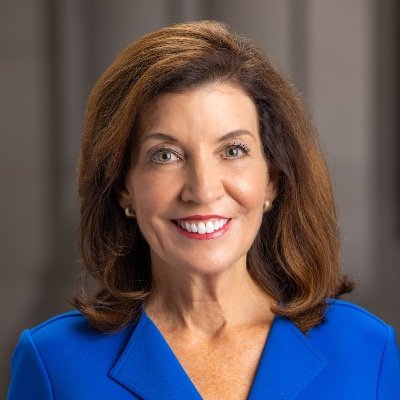

New York Governor Kathy Hochul has vetoed laws that will have strengthened the New York False Claims Act.

New York is likely one of the few states which have a False Claims Act that applies to taxes. People and firms that knowingly file a false tax type are liable below the New York regulation.

However there’s a loophole — people and firms that fail to file any tax returns in any respect escape legal responsibility.

In June 2021, the New York legislature handed laws (S.4730 and A.2453) that plugged that loophole for companies and people with internet revenue or gross sales over $1 million.

However the huge 4 accounting corporations and their commerce group, the American Institute of Licensed Public Accountants, argued that the regulation was overly broad and will apply to accounting corporations.

“I’m absolutely supportive of efforts to detect and penalize unlawful or improper tax submitting practices,” Hochul mentioned in her veto message to the Senate. “The sponsors point out their purpose is to seize these people or companies who improperly keep away from tax obligations by not submitting any tax returns in any respect. Nevertheless, the language within the invoice is broader than impacting solely non-filers, and would implicate extra tax submitting controversies to the False Claims Act than simply non-filers. This may be incongruent with the best way different states and the federal authorities pursue False Claims Act violations, and will have the impact of incentivizing non-public events to deliver unjustified claims below the regulation.”

“There are administrative and felony treatments within the regulation at present that tackle this conduct. I agree nonetheless that continued efforts should be made to deal with non-filers, and I’m absolutely supportive of the sponsors’ efforts to deal with a possible oversight within the State’s legal guidelines which will incentivize non-filing of taxes.”

Hochul added that “on this time of nice uncertainty for companies, I can not help a invoice which will have these unintended penalties.”

Neil Getnick, the managing associate of Getnick & Getnick, an anti-fraud regulation agency with a robust whistleblower apply, advised Company Crime Reporter that “whereas this can be a time of nice uncertainty for companies, one factor is for sure — it’s no answer to permit companies that are tax cheats to compete unfairly with regulation abiding companies which pay their taxes.”

“That solely exacerbates the state of affairs,” Getnick mentioned.

[ad_2]

Source link